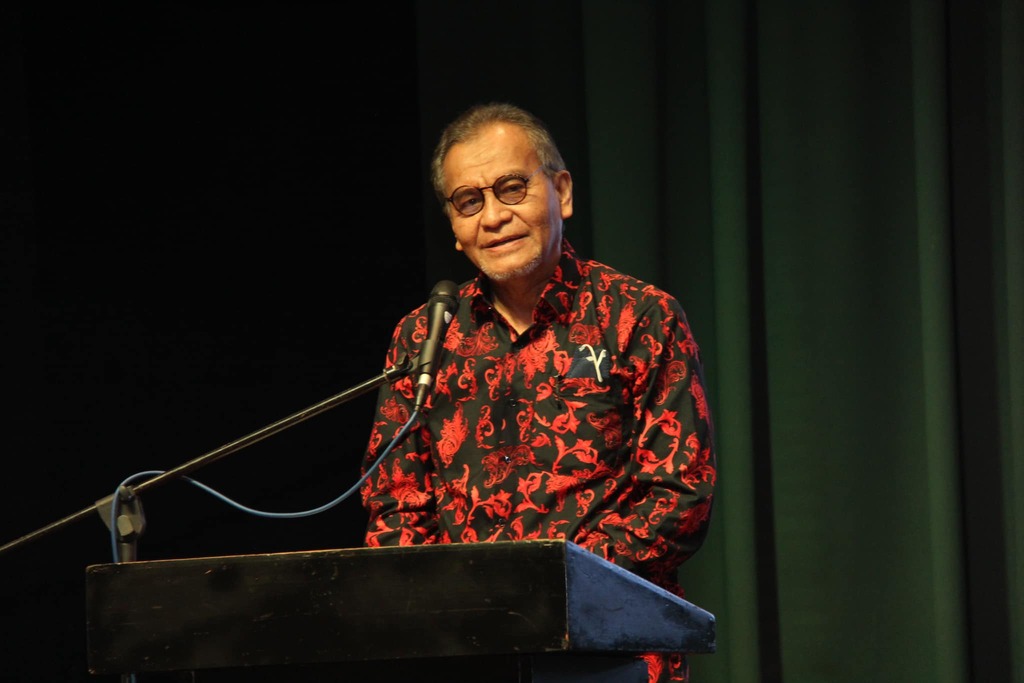

KUALA LUMPUR – The government should consider re-introducing the inheritance tax, similar to Organisation for Economic Cooperation and Development (OECD) countries, said Datuk Seri Dzulkefly Ahmad (Kuala Selangor-PH), when debating the Supply Bill 2024.

Citing South Korea, he said that Samsung heir Lee Jae Yong had paid a significant amount of USD$6 billion (RM28 billion) in inheritance tax.

“I think it is time for the government to re-introduce the inheritance tax,” said Dzulkefly, who is a former health minister.

It is understood that the inheritance tax was first imposed under the Estate Duty Enactment 1941, but was repealed in November 1991 by then Prime Minister Tun Dr Mahathir Mohamad.

At the same time, Dzulkefly said that taxation is a form of ‘redistributive justice’, which allows wealth to be redistributed to deserving individuals.

“In Islam, it is said that you take from the wealthy and give to those who are in need, such as asnaf (those eligible for zakat).”

Dzulkefly also urged the government to study our taxation system and ensure it is progressive, to encourage taxpayers to pay their taxes.

“The rich are either paying less tax or not paying at all compared to the low income earners.

“The top ten richest people in Malaysia are not paying their taxes accordingly, and they are richer than the Singaporean elites.” – October 18, 2023