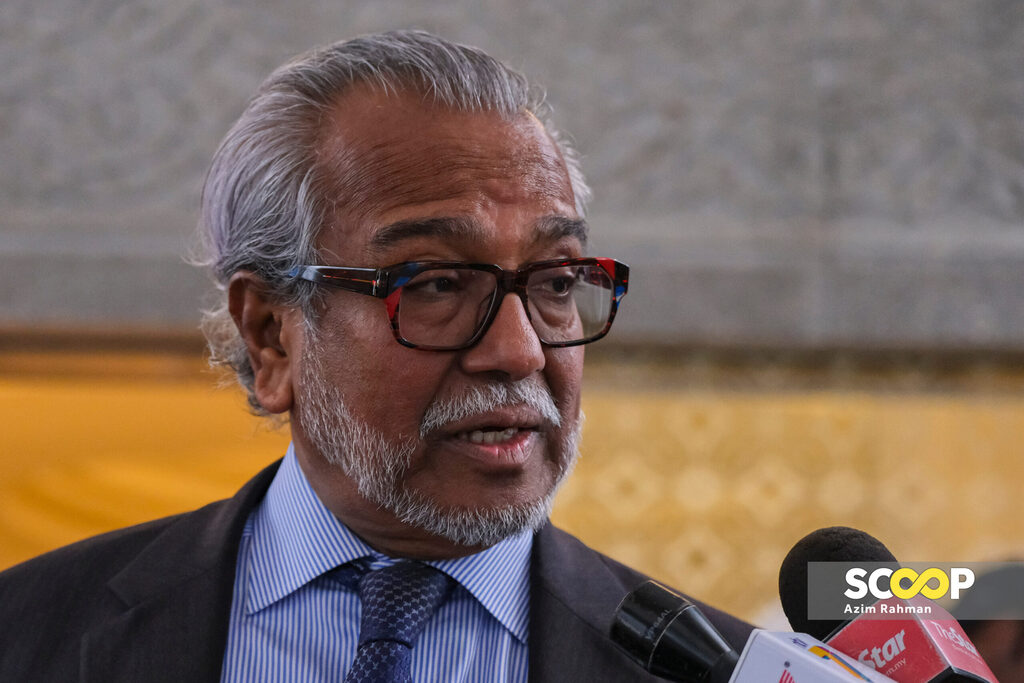

KUALA LUMPUR – The high court, here, ordered lawyer Tan Sri Shafee Abdullah to pay more than RM5.5 million in tax arrears to the Inland Revenue Board (IRB).

This follows the decision of the same court on December 15 which allowed the IRB’s application to obtain a direct judgment in its suit against the senior lawyer to obtain arrears of income tax for the Assessment Years 2011, 2012, 2013, 2014 and 2016.

The direct judgment refers to a judgment made by a court for one party against another party without going through a full trial.

According to Berita Harian, today’s proceedings were set to determine the amount of outstanding income tax to be paid by the lawyer. In proceedings before judicial commissioner Roz Mawar Rozain, senior revenue counsel Norhisham Ahmad informed that the final amount to be paid by Shafee stood at RM5,529,577.70.

Meanwhile, lawyer Muhammad Farhan Shafee who represented his father told the court that he will seek further instructions on whether to appeal the court’s decision to allow the judgment to continue.

In her judgment when allowing the direct judgment application, Roz Mawar said that based on the affidavit, Shafee had no defence against the claim and there were no issues that required witness testimony at the full trial.

On September 28, 2021, IRB applied for direct judgement in its suit against Shafee, which was filed on May 6, 202.

The high court then decided by direct judgment on the grounds that the defendant failed to pay income tax arrears amounting to RM9,414,708.32 within the stipulated period.

IRB claimed that the lawyer failed to pay the amount of income tax owed for the Assessment Years 2011, 2012, 2013, 2014 and 2016 including the penalty on the amount charged.

On October 28, last year, the high court acquitted Shafee on two charges of receiving proceeds from illegal activities amounting to RM9.5 million from former prime minister Datuk Seri Najib Razak and two charges of filing incorrect statements to the IRB.

The prosecution that appealed against the court’s decision, however, withdrew the appeal on December 5, making the court’s decision to acquit Shafee permanent. – December 21, 2023