CYBERJAYA – Prime Minister Datuk Seri Anwar Ibrahim has called on the Inland Revenue Board (IRB) to intensify efforts to bolster the country’s tax revenue, particularly from affluent individuals who may be evading their tax obligations.

The prime minister emphasised the necessity of a stringent approach to tax collection, saying the IRB needed to move more aggressively against those who refuse to pay their taxes.

Anwar warned that the IRB would take necessary actions against those who fail to fulfil their tax obligations.

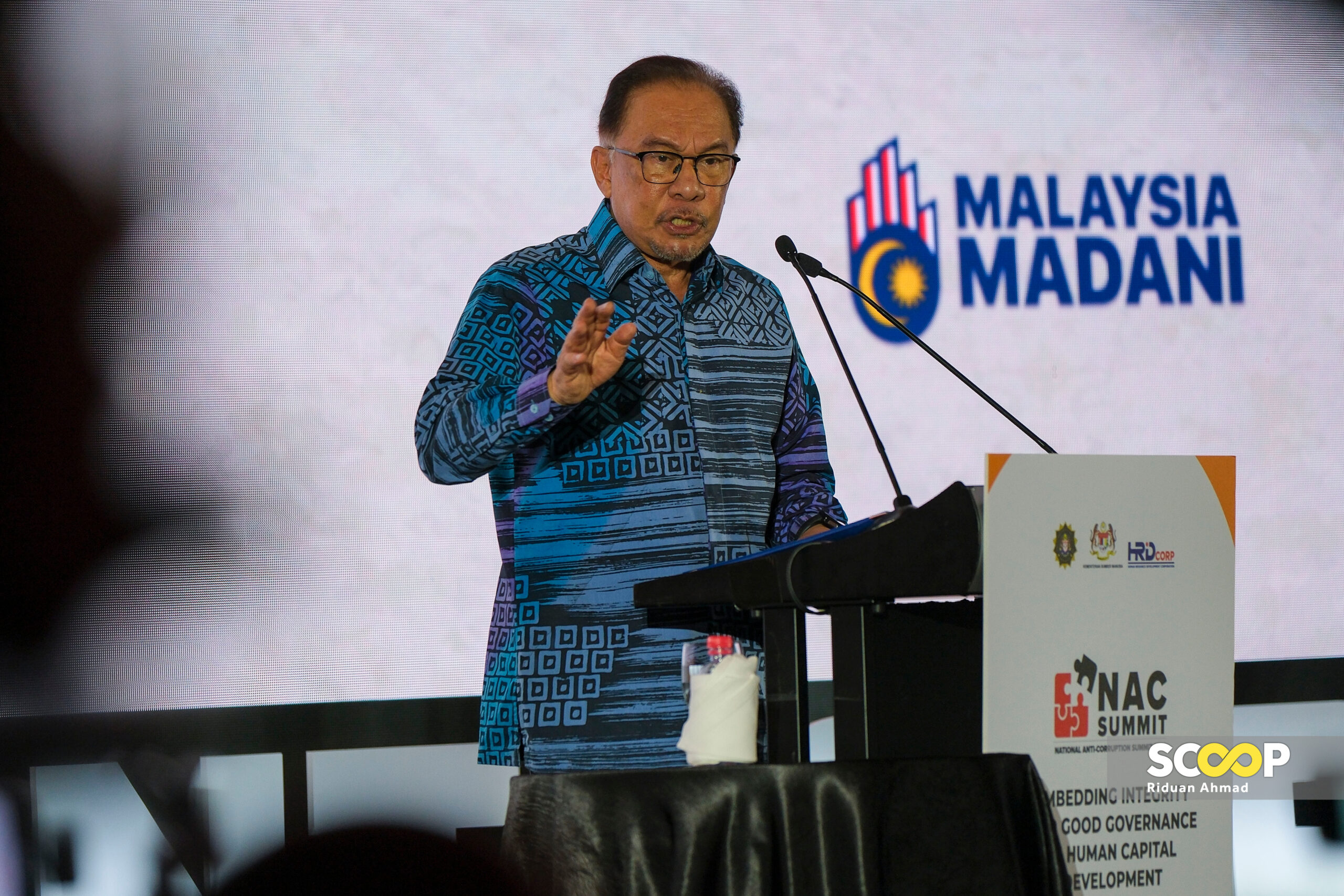

“If there is a need for the IRB to be stricter, then so be it. Individuals with influence and high positions should not assume they can escape their tax responsibilities,” Anwar said during his address at the IRB’s 28th Revenue Day celebration today.

“There must be a serious commitment to tax the ultra-rich. If they don’t pay, then (IRB should) investigate and take action.”

Also present was IRB chief executive officer Datuk Abu Tariq Jamaluddin.

Anwar commended the IRB for achieving a historic milestone in national tax collection, reaching RM183.34 billion last year – an increase of RM7.8 billion or 4.49% compared to the previous year.

He highlighted that the increased revenue, attributed to the Customs Department’s efforts, has significantly contributed to enhancing the government’s Sumbangan Asas Rahmah programme, doubling payments and expanding the number of recipients to 700,000 from 210,000 the previous year.

However, Anwar expressed concern over the low tax compliance among registered companies, revealing that less than 29% of the 1.5 million companies in the country paid taxes.

Despite Malaysia’s lower basic tax rate compared to neighbouring countries, Anwar stressed the need for improvement.

“Malaysia still has a low tax base, approximately 11.2% of the gross domestic product, in contrast to neighbouring countries such as Singapore (12.6%) and Thailand (16.4%).”

Anwar underscored the urgency for more companies to fulfil their tax obligations, indicating that out of the 1.5 million registered companies, only around 435,000 were recorded as paying taxes last year. – March 1, 2024