KUALA LUMPUR – Digital Minister Gobind Singh Deo hopes GXBank’s transformative strides in the digital banking industry will not only help build Malaysia’s digital economy but also scale businesses in both the country and the region.

Commenting on the speed of digitalisation in commercial interactions, Gobind said the presence of such digital banks in Malaysia would benefit the nation.

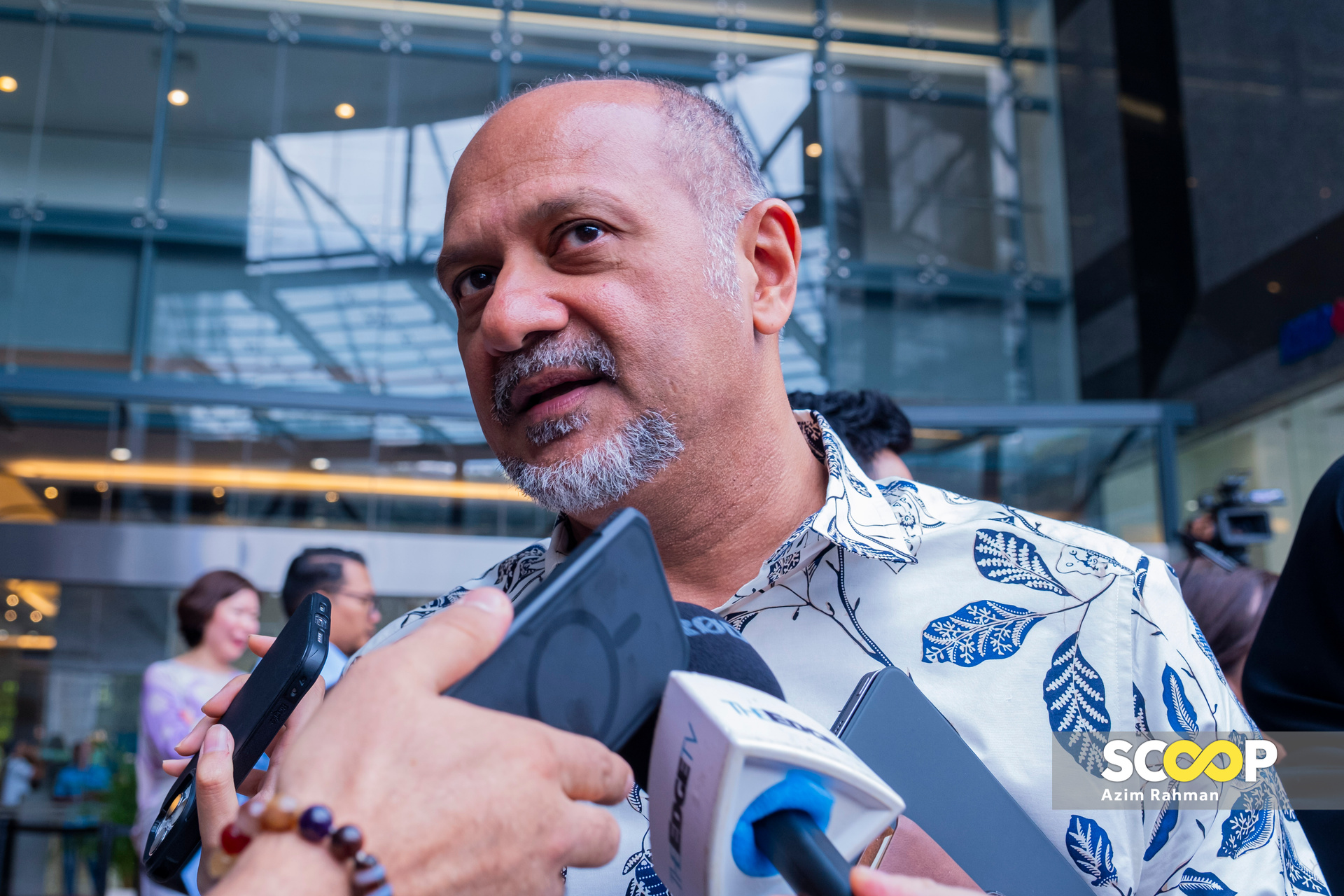

“When you look at initiatives like these, they help build the digital economy and scale businesses not just in Malaysia but across the region,” Gobind told the press after the launch of GXBank’s headquarters and its GX Untuk Semua campaign.

At the same time, the minister also mentioned that GXBank’s footprint in the industry would encourage similar initiatives in Malaysia, adding that it is necessary as the country moves to digitise its infrastructure further.

“We want to call for more initiatives that allow payments of this nature.

“As you can see, the prime minister’s presence here to launch the event shows that the government supports such initiatives, and I believe this helps develop ecosystems that would enhance how we perform in the digital economy in years to come,” Gobind added.

Earlier, at the launch event, Prime Minister Datuk Seri Anwar Ibrahim said Malaysia must expedite the transformation of digital banks in the country to avoid being left behind by its regional peers.

He also emphasised that the government has taken steps to ensure digital financial institutions such as GXBank no longer face hurdles to implement changes efficiently.

Anwar said that digital banks must prioritise the people’s interests to remain sustainable, in addition to raising the people’s awareness and understanding of digital banks.

Meanwhile, GXBank chairperson Datuk Zaiton Mohd Hassan said that given financial systems form the cornerstone of the industry’s technological revolution, “brick and mortar” banks are required to evolve to remain relevant.

Further, as the nation’s first, Zaiton added that GXBank does not only aim to provide digital services but also democratise access to financial systems for all Malaysians.

GXBank’s GX Untuk Semua initiative forms part of the company’s RM1.5 billion investment in Malaysia over the next five years and will introduce AI-based solutions for risk and fraud management, as well as personal and micro, small, and medium enterprise (MSME) lending solutions. – August 2, 2024